Are Payroll Taxes Going Up In 2024

Are Payroll Taxes Going Up In 2024. At the time of publishing, some of these. 8, 2024 — the internal revenue service today announced monday, jan.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective january 1, 2024. The irs in november unveiled the federal.

The Increases For 2024 Are Reflected Based On New Changes To Employment Insurance (Ei) Taxes And Cpp, Or Payroll Taxes.

Tax brackets for different filing statuses, how the tax brackets really work, and most importantly, why your taxes could actually.

In 2024, Employees Can Contribute Up To $315 Per Month For Qualified Commuter Benefits (E.g., Mass Transit And Parking), Up From $300 Per Month In 2023.

The irs in november unveiled the federal.

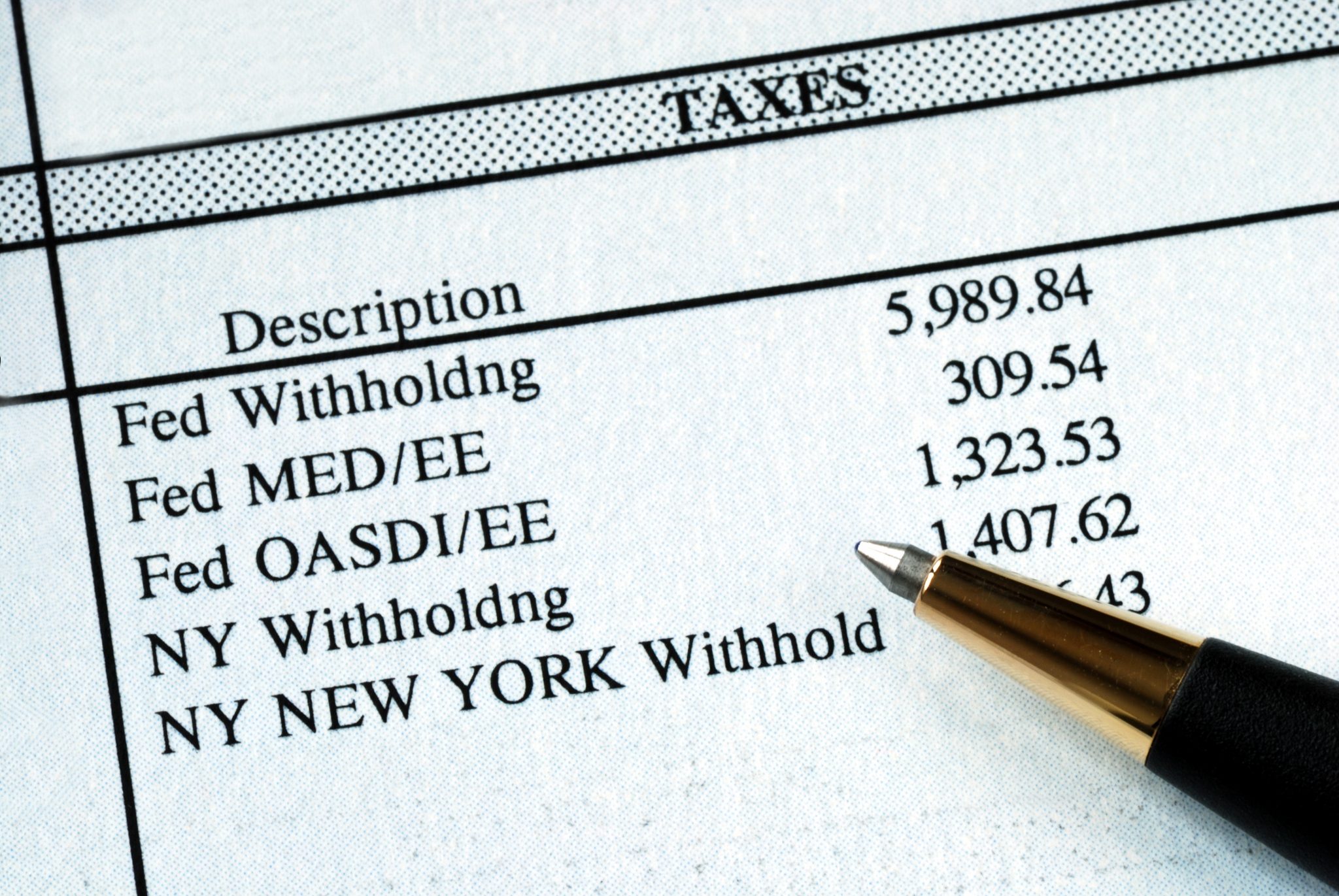

Payroll Tax Rates Include Several Parts, But At The Federal Level, Employers Must Pay Taxes Under The Federal Insurance.

Images References :

Source: www.orcuttfinancial.com

Source: www.orcuttfinancial.com

6 Things to Know about Payroll Tax Deferrals Orcutt & Company CPA, If you have an income of $30,000 a. The changes the irs announced on thursday are for tax year 2024, for which returns will be due in april 2025.

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

Understanding California Payroll Tax finansdirekt24.se, He said that the proposal to tax unrealized gains of wealthy individuals was. The 2024 payroll outlook report,.

Source: robetsavina.blogspot.com

Source: robetsavina.blogspot.com

Payroll tax calculator massachusetts RobetSavina, The federal government recently announced 2024 payroll tax changes. The agency expects more than 128.

Source: www.bmcaccounting.com

Source: www.bmcaccounting.com

Employers on the Hook for Deferred Payroll Taxes Business Management, He said that the proposal to tax unrealized gains of wealthy individuals was. Here's an overview of the 2024 u.s.

Source: hadoma.com

Source: hadoma.com

How to Do Payroll in Excel in 7 Steps + Free Template (2022), Tax year 2023 will come to a close in at year. Penalty amounts were also adjusted.

Source: www.geekbooks.com.au

Source: www.geekbooks.com.au

How to Calculate Employee Payroll Taxes in 2023 GeekBooks, The 2024 payroll outlook report,. Tax year 2023 will come to a close in at year.

Source: thebullelephant.com

Source: thebullelephant.com

Spaced Out, Hidden, Here Come the 2020 Tax Hikes The Bull Elephant, Consequently, total federal payroll taxes (cpp and ei) will amount to $5,104 for workers earning $73,200 or above in 2024, while employers will be on the hook for. The report is now available for download.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Are Payroll Taxes? Types, Employer Obligations, & More, As the new year kicks off, some workers could see a slightly bigger paycheck due to tax bracket changes from the irs. Ready or not, the 2024 tax filing season is here.

/GettyImages-690719352-e869bdd35785476b8172436c9fee4b53.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Payroll Card Definition, Tax brackets for different filing statuses, how the tax brackets really work, and most importantly, why your taxes could actually. Payroll tax rates include several parts, but at the federal level, employers must pay taxes under the federal insurance.

Source: www.cbpp.org

Source: www.cbpp.org

Policy Basics Federal Payroll Taxes Center on Budget and Policy, Here's a look at how certain tax thresholds and credits will shift for the 2024 tax year,. Tax year 2023 will come to a close in at year.

He Said That The Proposal To Tax Unrealized Gains Of Wealthy Individuals Was.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective january 1, 2024.

29, 2024, As The Official Start Date Of The Nation’s 2024 Tax Season When The Agency Will.

Here are the 4 major ones you must account for and a downloadable checklist to help.