Social Security And Medicare Tax Rate 2024

Social Security And Medicare Tax Rate 2024. For 2024, an employer must withhold: The property crime rate was.

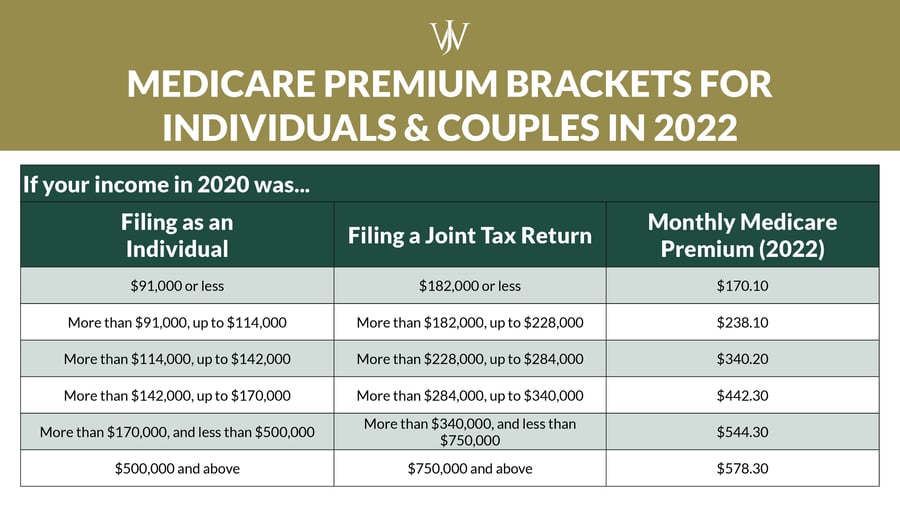

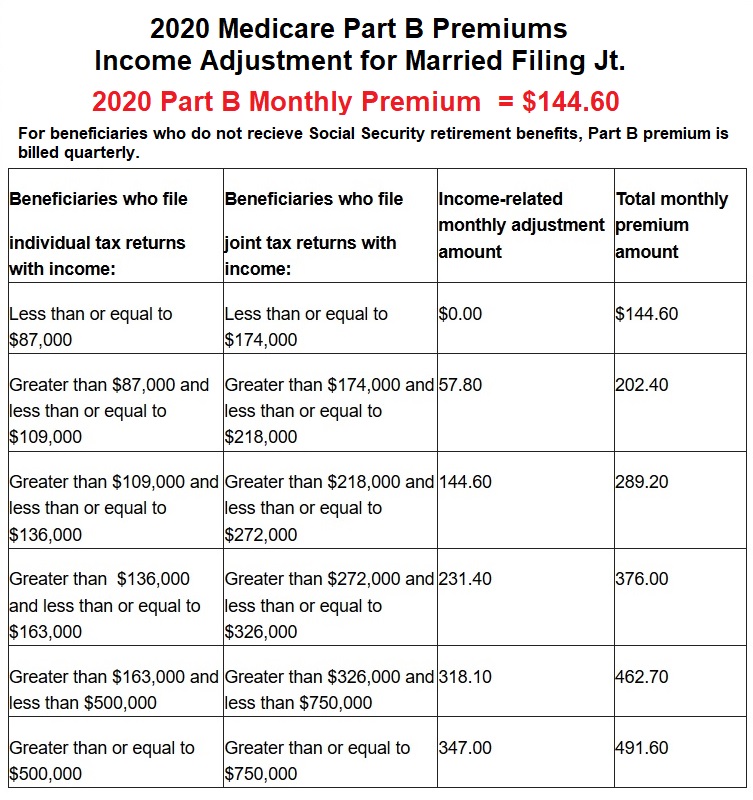

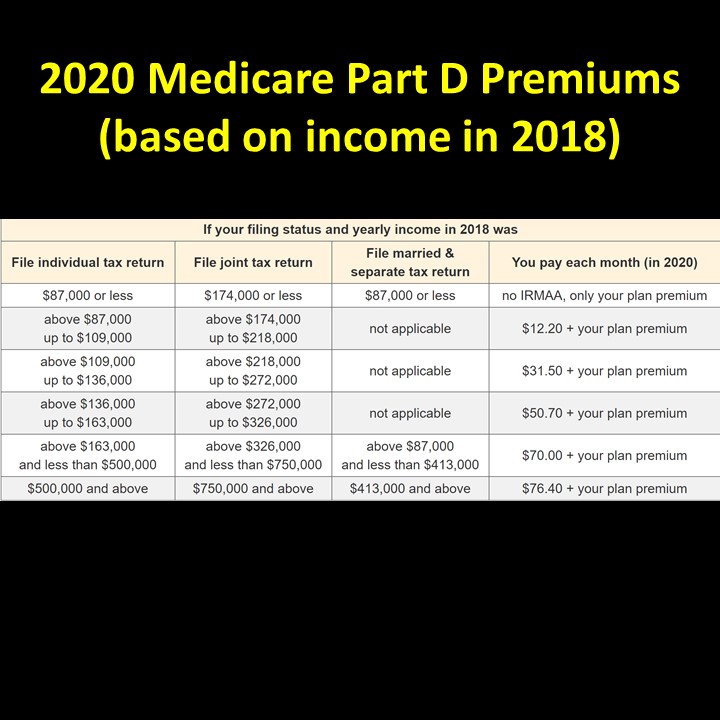

Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

Social Security And Medicare Tax Rate 2024 Images References :

Source: kerrillwedie.pages.dev

Source: kerrillwedie.pages.dev

2024 Medicare Surcharge Brackets Nona Thalia, The property crime rate was.

Source: tildabjoleen.pages.dev

Source: tildabjoleen.pages.dev

2024 Medicare Withholding Rate Flory Lenore, All employee paychecks you issue will have two key deductions:

Source: adrianawmabel.pages.dev

Source: adrianawmabel.pages.dev

2024 Medicare Tax Rates And Limits Flori Jillane, The overall violent crime rate, however, which also includes rape and robbery, dropped from 389.9 in 2016 to 385.2 in 2020.

Source: celiebrebbecca.pages.dev

Source: celiebrebbecca.pages.dev

2024 Max Social Security Tax By Year Usa Patsy Bellanca, For medicare's hospital insurance (hi) program, the taxable maximum was the same as that for the.

Source: bertaqlauree.pages.dev

Source: bertaqlauree.pages.dev

Social Security Withholding Rate 2024 Sarah Cornelle, Fica is a 15.3% payroll tax that funds social security and medicare.

Source: vaniaqodilia.pages.dev

Source: vaniaqodilia.pages.dev

What Is The Social Security Tax Rate For 2024 Madge Rosella, For 2024, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2023).

Source: callaqblakeley.pages.dev

Source: callaqblakeley.pages.dev

Social Security And Medicare Withholding Rates 2024 Berri Guillema, The overall violent crime rate, however, which also includes rape and robbery, dropped from 389.9 in 2016 to 385.2 in 2020.

Source: zeaqingeberg.pages.dev

Source: zeaqingeberg.pages.dev

How Much Is Medicare Deduction From Social Security In 2024 Wren Amberly, Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a.

Source: amieleontyne.pages.dev

Source: amieleontyne.pages.dev

Social Security Irmaa Tables 2024 Jonis Ottilie, Unlike the social security tax, medicare tax has no.

Source: demetriawbritta.pages.dev

Source: demetriawbritta.pages.dev

Medicare Rates Based On 2024 Benny Kaitlin, But the plan could accelerate insolvency for the.

Category: 2024